WELCOME TO PROMISEDPAGE

SMART LEARNING BLOG

HOME

Monday, August 4, 2025

Sunday, September 29, 2024

Money and Credit Class 10 MCQs Questions with Answers

Choose the correct option:

Question 1.

Which one of the following is a formal source of credit?

(a) Traders

(b) Cooperative societies

(c) Moneylenders

(d) Friends and relatives

Answer

Answer: (b) Cooperative societies

Question 2.

Which one of the following is the appropriate meaning of collateral?

(a) It is the sum total of money borrowed from banks.

(b) The amount borrowed from friends.

(c) It is an asset of the borrower used as guarantee to a lender.

(d) The amount invested in a business.

Answer

Answer: (c) It is an asset of the borrower used as guarantee to a lender.

Question 3.

Which one of the following is a modern form of currency?

(a) Paper notes

(b) Gold

(c) Silver

(d) Copper

Answer

Answer: (a) Paper notes

Question 4.

Which one of the following is the newer way of providing loans to the rural

poor, particularly women?

(a) Cooperative Banks

(b) Grameen Banks

(c) Self-Help Groups

(d) Moneylenders

Answer

Answer: (c) Self-Help Groups

Question 5.

Which of the following is the main informal source of credit for rural

households in India?

(a) Friends

(b) Relatives

(c) Landlords

(d) Moneylenders

Answer

Answer: (d) Moneylenders

Question 6.

Name the system in which the double coincidence of wants is an essential

feature.

(a) Barter system

(b) Money economy

(c) Global economy

(d) None of these

Answer

Answer: (a) Barter system

Question 7.

Grameen Bank of Bangladesh was started in

(a) 1960s

(b) 1970s

(c) 1980s

(d) 1990s

Answer

Answer: (b) 1970s

Question 8.

In a SHG, most of the decisions regarding loan activities are taken by

(a) Banks

(b) Members

(c) Non-government organisation

(d) Cooperative

Answer

Answer: (b) Members

Question 9.

Which of the following is not an informal source of credit?

(a) Money-lender

(b) Relatives and Friends

(c) Commercial Banks

(d) Traders

Answer

Answer: (c) Commercial Banks

Question 10.

In which country is the Grameen Bank meeting the credit needs of over 6

million poor people?

(a) Bhuta

(b) Sri Lanka

(c) Bangladesh

(d) Nepal

Answer

Answer: (c) Bangladesh

Question 11.

Which is not the main source of credit from the following for rural households

in India?

(a) Traders

(b) Relatives and friends

(c) Commercial Banks

(d) Moneylanders

Answer

Answer: (a) Traders

Question 12.

What portion of deposits are kept by the banks for their day to day

transaction?

(a) 10%

(b) 15%

(c) 20%

(d) 25%

Answer

Answer: (b) 15%

Question 13.

Which households take more loans from the formal sector?

(a) Poor households and rich household.

(b) Well off households and households with few assets.

(c) Poor households and well off households

(d) Well off households and rich households.

Answer

Answer: (d) Well off households and rich households.

Question 14.

Which among these is an essential feature of barter system?

(a) Money can easily exchange any commodity

(b) It is based on double co-incidence of wants

(c) It is generally accepted as a medium of exchange of goods with money

(d) It acts as a measure and store of value

Answer

Answer: (b) It is based on double co-incidence of wants

Question 15.

Which one of the following is the main source of credit for the rich

households?

(a) Informal

(b) Formal

(c) Both formal and informal

(d) Neither Formal nor informal

Answer

Answer: (b) Formal

Question 16.

Which one of the following is not a formal source of credit?

(a) Commercial Banks

(b) State Bank of India

(c) Employers

(d) Co-operatives

Answer

Answer: (c) Employers

Question 17.

Which one of the following agencies issues currency notes on behalf of the

government of India?

(a) Ministry of Finance

(b) Reserve Bank of India

(c) State Bank of India

(d) World Bank

Answer

Answer: (b) Reserve Bank of India

Question 18.

Formal Sources of credit include :

(a) money lenders

(b) co-operatives

(c) Employers

(d) Finance companies

Answer

Answer: (b) co-operatives

Question 19.

Which one of the following is NOT an informal sector loans for poor rural

household in India?

(a) Commercial Banks

(b) Moneylenders

(c) Traders

(d) Landlords

Answer

Answer: (a) Commercial Banks

Question 20.

Which one of the following is not a modern form of money?

(a) Demand Deposits

(b) Paper currency

(c) Coins

(d) Precious metals

Answer

Answer: (d) Precious metals

Question 21.

Identify the formal source of credit:

(a) Cooperative societies

(b) Moneylenders

(c) Traders

(d) Landlords

Answer

Answer: (a) Cooperative societies

Question 22.

Who helps the borrowers to overcome the problem of lack of collateral?

(a) Self-help group (SHG)

(b) State government

(c) Employers

(d) Moneylenders

Answer

Answer: (a) Self-help group (SHG)

Question 23.

Which of the following is not a modern form of money?

(a) Paper notes

(b) Demand deposits

(c) Silver coins

(d) None of the above

Answer

Answer: (c) Silver coins

Question 24.

Formal sources of credit include

(a) banks

(b) moneylenders

(c) employers

(d) all the above

Answer

Answer: (a) banks

Question 25.

Rate of interest charged by moneylenders as compared to that charged by banks

is:

(a) lower

(b) same

(c) slightly higher

(d) much higher

Answer

Answer: (d) much higher

Question 26.

Which state accounts for maximum percentage of SHGs (self-help groups) in bank

credit?

(a) Andhra Pradesh

(b) Tamil Nadu

(c) Kerala

(d) Karnataka

Answer

Answer: (a) Andhra Pradesh

Question 27.

Who supervises the credit activities of lenders in the informal sector?

(a) Central Bank of India

(b) Commercial banks

(c) Moneylenders

(d) None

Answer

Answer: (d) None

Question 28.

At present which form of money is increasingly used apart from paper money?

(a) Commodity money

(b) Metallic money

(c) Plastic money

(d) All the above

Answer

Answer: (c) Plastic money

Question 29.

Currency is issued in India by :

(a) commercial banks

(b) regional rural banks

(c) nationalised banks

(d) Reserve Bank of India

Answer

Answer: (d) Reserve Bank of India

Question 30.

The part of the total deposits which a bank keeps with itself in cash is

(a) zero

(b) a small proportion

(c) a big proportion

(d) 100 percent

Answer

Answer: (b) a small proportion

Question 31.

System of exchanging goods for goods is called:

(a) monetary system

(b) credit system

(c) barter system

(d) exchange system

Answer

Answer: (c) barter system

Question 32.

Money

(a) eliminates double-coincidence of wants

(b) acts as a common measure of value

(c) acts as a standard of deferred payments

(d) all the above

Answer

Answer: (d) all the above

Money and Credit Class 10 Quiz

Please fill the above data!

Name : Apu

Roll : 9

Total Questions:

Correct: | Wrong:

Attempt: | Percentage:

Multiple Choice Questions

1. Which one of the following statements is most appropriate regarding a transaction made in money? [Delhi 2012]

(a) It is the easiest way

(b) It is the safest way

(c) It is the cheapest way

(d) It promotes trade

2. Which one of the following is the new way of providing loans to the rural poor? [Delhi 2012]

(a) Co-operative societies

(b) Traders

(c) Relatives and friends

(d) SHG’s

3. Which among the following authorities issues currency notes? [Delhi 2012]

(a) Government of India

(b) The State Bank of India

(c) Central Bank

(d) Reserve Bank of India

4. Banks provide a higher rate of interest on which one of the following accounts ? [AI 2012]

(a) Saving account

(b) Current account

(c) Fixed deposits for a long period

(d) Fixed deposits for a very short period

5. Which one of the following is the main source of credit for rich urban households in India ? [AI 2012]

(a) Formal sector

(b) Informal sector

(c) Moneylenders

(d) Traders

6. Which one of the following is an essential feature of the barter system?

(a) It promotes local market.

(b) It spreads social field of an individual.

(c) It requires double coincidence of wants.

(d) It is an easy way.

7. Which one of the following terms is not included against loans? [CBSE CCE 2012]

(a) Interest rate

(b) Collateral

(c) Documentation

(d) Lender’s land

8. What is main source of income for banks? [CBSE CCE 2012]

(a) Interest on loans

(b) Interest on deposits

(c) Difference between the interest charged on borrowers and depositors

(d) None of these

9. In which one of the following systems exchange of goods is done without use of money? [CBSE (CCE) 2012]

(a) Credit system

(b) Barter system

(c) Banking system

(d) Collateral system

10. Which of the following has an essential feature of double coincidence? [CBSE (CCE) 2012]

(a) Money system

(b) Barter system

(c) Financial system

(d) Banking system

11. What percent of their deposits do bank hold as cash? [CBSE(CCE)2012]

(a) 50 percent

(b) 80 percent

(c) 15 percent

(d) 60 percent

12. Which of the following is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender? [CBSE(CCE)2012]

(a) Property

(b) Money

(c) Collateral

(d) Deposits

13. How many members a typical Self-Help Group Should have? [CBSE (CCE) 2012]

(a) 14 – 19

(b) 15 – 20

(c) 20 – 25

(d) 25 – 30

14. In a barter system: [CBSE (CCE) 2012]

(a) Goods are exchanged for money.

(b) Goods are exchanged for foreign currency.

(c) Goods are exchanged without the use of money.

(d) Goods are exchanged on credit.

15. About what percentage of their deposits is kept as cash by the banks in India? [CBSE (CCE) 2012]

(a) 25 %

(b) 20 %

(c) 15 %

(d) 10 %

16. Why do banks keep a small proportion of the deposits as cash with themselves? [Delhi 2011]

(a) To extend loan to the poor.

(b) To extend loan facility.

(c) To pay salary to their staff.

(d) To pay the depositors who might come to withdraw money.

17. The currency notes on behalf of the Central Government are issued by whom? [Delhi 2011]

(a) State Bank of India

(b) Reserve Bank of India

(c) Punjab National Bank

(d) Central Bank of India

18. Which one of the following is not a feature of money? [AI 2011]

(a) Medium of exchange

(b) Lack of divisibility

(c) A store of value

(d) A unit of account

19. Professor Muhammad Yunus is the founder of which one of the following banks? [AI 2011]

(a) Cooperative Bank

(b) Commercial Bank

(c) Grameen Bank

(d) Land Development Bank

20. Which one of the following is a modern form of currency? [Foreign 2011]

(a) Gold

(b) Silver

(c) Copper

(d) Paper notes

21. The Informal source of credit does not include which one of the following? [Foreign 2011]

(a) Traders

(b) Friends

(c) Cooperative Societies

(d) Moneylenders

Additional Questions

22. Anything which is generally accepted by the people in exchange of goods and services

(a) Money

(b) Barter

(c) Credit

(d) Loans

23. Both parties agree to sell and buy each other’s commodities

(a) Measure of value

(b) Store of value

(c) Double coincidence of wants

(d) Credit

24. Money acts as an intermediate in the exchange process. Which function of money is highlighted here?

(a) Measure of value

(b) Medium of Exchange

(c) Store of value

(d) All of them

25. Modern forms of money include

(i) Gold

(ii) Paper Notes

(iii) Coins

(iv) Silver

(a) (i) and (iii)

(b) (ii) and (iv)

(c) (iii) and (iv)

(d) (ii) and (iii)

26. Mpney is accepted as a medium of exchange because the currency is authorised by

(a) Private sector

(b) Public sector

(c) Government

(d) People

27. Deposits in the bank accounts can be withdrawn on demand, therefore these deposits are called

(a) Returnable deposits

(b) Acceptable Deposits

(c) Demand deposits

(d) None of the above

28. It is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name it has been made is

(a) Paper note

(b) Cheque

(c) Chit fund

(d) Credit card

29. Banks use the major portion of the deposits to

(a) Keep as a reserve so that people may withdraw

(b) Meet their routine expenses

(c) Extend loans

(d) Meet renovation of the bank

30. An agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

(a) Credit (loan)

(b) Chit fund

(c) Bank

(d) Cheque

31. Salim, the shoe manufacturer, to meet expenses obtains loans from two sources.

(i) Asks leather supplier to supply leather on credit

(ii) Bank

(iii) Obtains loan in cash as advance payment

(iv) Relatives

(a) (i) and (iii)

(b) (i) and (ii)

(c) (iii) and (iv)

(d) (ii) and (iii)

32. Swapna is unable to repay the moneylender and she is caught in debt. She has to sell a part of the land to pay off the debt. This situation is an example of

(a) Debt-loss

(b) Debt-Insecurity

(c) Debt-trap

(d) All of them

33. Whether credit would be useful or not, depends on

(i) Whether there is some support in case of loss

(ii) Action of competitors

(iii) Market response

(iv) Risks in the situation

(a) (i) and (iii)

(b) (ii) and (iv)

(c) (ii) and (iii)

(d) (i) and (iv)

34. Terms of credit does not include

(a) Interest rate

(b) Collateral

(c) Cheque

(d) Mode of repayment

35. Krishak cooperative functioning in a village near Sonpur has ……………. farmers as members.

(a) 2500

(b) 2400

(c) 2350

(d) 2300

36. Formal sector loans include loans from

(i) Banks

(ii) Moneylenders

(iii) Cooperatives

(iv) Traders

(a) (i) and (iii)

(b) (ii) and (iv)

(c) (ii) and (iii)

(d) (i) and (iv)

37. Contribution of commercial banks as a source of credit for rural households in India in 2003 was

(a) 30 %

(b) 28 %

(c) 25 %

(d) 26 %

38. Organisation which supervises the credit activities of lenders in the informal sector.

(a) No organization

(b) Reserve Bank of India (RBI)

(c) State Government

(d) Central Government

39. Compared to the formal lenders, most of the informal lenders charge a much …………….. interest on loans

(a) Lower

(b) Constant

(c) Higher

(d) No interest

40. Formal sector meets only about …………… of the total credit needs of the rural people (in 2003)

(a) one third

(b) one fourth

(c) half

(d) whole

41. It is important that the formal credit is distributed more equally so that

(a) Poor can benefit from cheaper loans.

(b) Rich can get costly loans.

(c) Rich can get cheaper loans.

(d) None of the above.

42. After a year or two, if the SHG is regular in savings, it becomes eligible for availing loan from

(a) Cooperative societies

(b) Moneylenders

(c) Bank

(d) Traders

43. ……………. help borrowers overcome the problem of lack of collateral and also they are the building blocks of organization of the rural poor.

(a) Government

(b) Banks

(c) Private sector

(d) SHGs

44. Almost all of the borrowers of Grameen Bank of Bangladesh are

(a) Men

(b) Women

(c) Senior citizens

(d) All of them

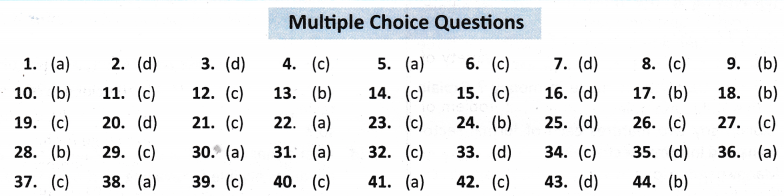

ANSWERS

JNV Chapter IV: VMC MCQs Chapter IV: Vidyalaya Management Committee (VMC) - MCQs Test your un...